Agreement Reached for the Export of Peruvian Blueberries to the Bolivian Market

Feb 25, 2025

December 23, 2024

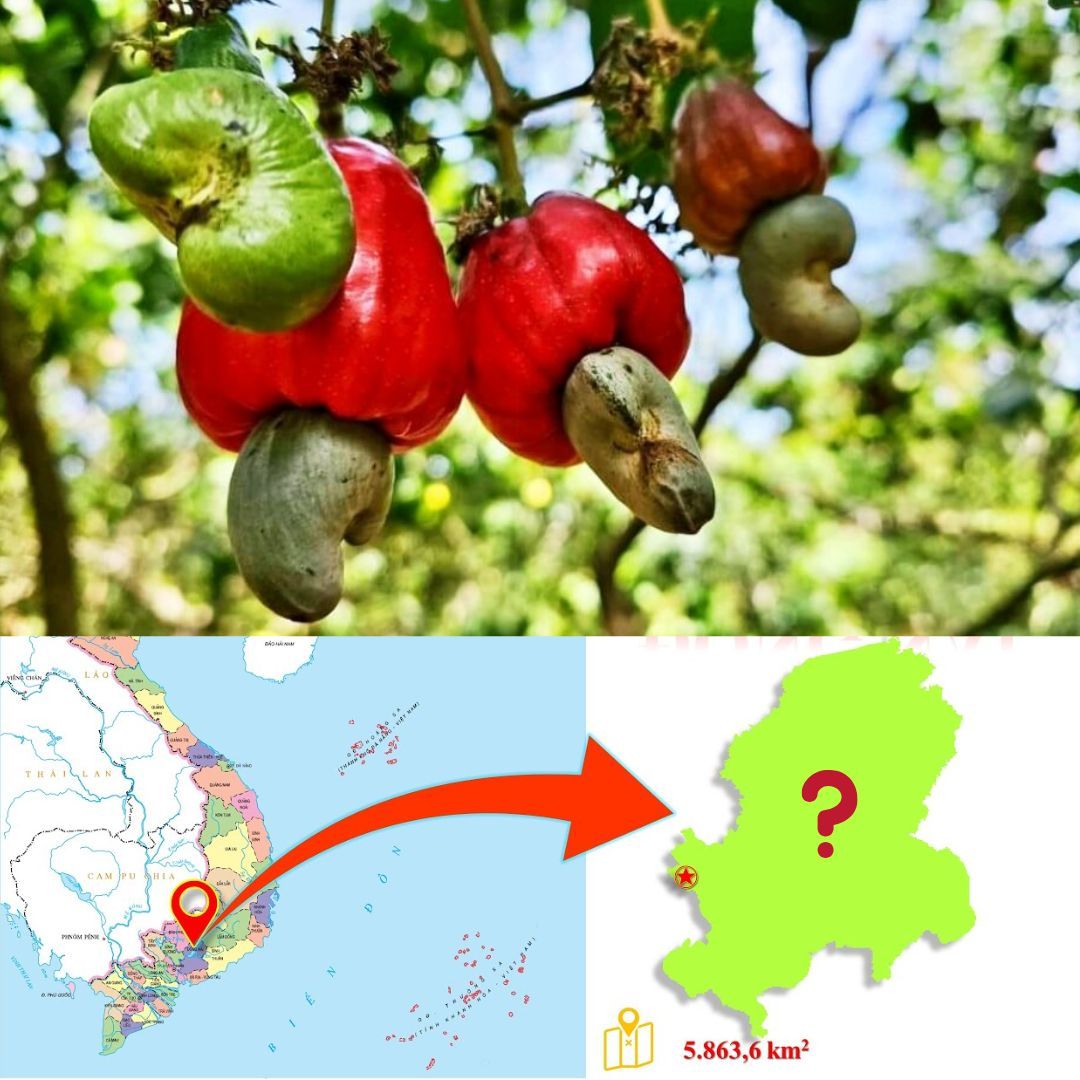

Exploring Vietnam's Leading Cashew-Producing Provinces

Cashew cultivation substantially impacts Vietnam's export value, helping the country become one of the world's leading agricultural commodity exporters. Some provinces, such as Binh Phuoc, Dong Nai, and Binh Duong, are the hubs of this industry, contributing significantly to the national harvest. In this article, we will explore these main provinces more closely and discover why they have high yields in cashew production.

Top Cashew Producing Provinces in Vietnam

Binh Phuoc: The Leading Producer

Binh Phuoc is the largest cashew-producing province in Vietnam, contributing 30% to 40% of the country’s total output. With around 120,000 hectares of cashew cultivation, it produces 150,000–200,000 tons annually. The advantage that creates high yields in this growing area is the fertile soil and a perfect climate for cashew growth.

Image: Cashew tree

Dong Nai: Strategic Location for Exports

Dong Nai is the second-largest producer, accounting for 15% to 20% of Vietnam’s cashew production, with a yield of 80,000–100,000 tons per year. The province’s proximity to Ho Chi Minh City and major ports makes it a key player in cashew exports. Its efficient transport networks allow for quick shipping to global markets, further enhancing its role in Vietnam's cashew industry.

Binh Duong: A Growing Hub

Binh Duong ranks third with an annual production of 60,000–70,000 tons. Though smaller than Binh Phuoc or Dong Nai, the province’s favorable climate has made it an increasingly important area for cashew cultivation. Binh Duong is also emerging as a hub for cashew processing, adding value to its production and contributing to its growing role in the industry.

Tay Ninh: Quality Over Quantity

Tay Ninh produces around 30,000–40,000 tons of cashews annually, accounting for 8% to 10% of the national output. The province focuses on high-quality nuts in demand in international markets. Tay Ninh is also investing in modern farming techniques to improve yield and quality, making it a rising player in Vietnam’s cashew sector.

Other Notable Provinces

Other provinces such as Gia Lai, Dak Lak, and Phu Yen each contribute 20,000 to 40,000 tons of cashews annually. These regions are working to expand their growing areas and improve nut quality, helping to ensure Vietnam's competitiveness in the global cashew market.

Why do these provinces have high yields in cashew production?

Favorable Natural Conditions and Climate

Tropical Climate: Cashew trees are planted in Vietnam's Southeast and Central Highlands due to the tropical climate with distinct dry and rainy seasons. Cashew trees grow well in warm climates with well-drained soil and a dry season for flowering and fruiting.

Fertile Land: Provinces such as Binh Phuoc, Dak Nong, and Gia Lai have fertile basalt soils that are ideal for cashew production. These soils have the optimal nutrients for growing cashew trees and delivering good harvests.

Fertile Basalt soils - Ideal for cashew cultivation

Historical and Traditional Production

These provinces have a long history of cashew cultivation, allowing them to gain valuable knowledge and expertise in producing, collecting, and processing cashews. Local farmers have an extensive understanding of the finest agricultural strategies for cashew growing.

Strong local networks of cooperatives and companies contribute to increased production efficiency and product quality through collaboration and shared knowledge.

Large Plantation Areas

Vietnam's largest cashew-producing province, Binh Phuoc, accounts for a significant portion of the country's total cashew nut production. Cashew plantations have expanded in recent years, boosting overall cashew nut yield. Other Central Highlands and Southeast provinces have also expanded their cashew-growing areas, replacing less productive crops.

Government and Local Support Policies

The Vietnamese government and local authorities have implemented policies to support the cashew industry, including:

- Tax incentives for cashew export businesses.

- Training programs for farmers on modern cashew cultivation techniques, pest management, and post-harvest handling.

- Subsidized loans for expanding cashew orchards and improving processing infrastructure.

There are also rural development programs that focus on improving local infrastructure, including building processing facilities and enhancing food safety standards for export.

Developed Processing and Export Networks

Processing industry: Provinces like Binh Phuoc have a well-established cashew processing industry, with large-scale factories for shelling, roasting, and packaging cashew nuts. This added value helps increase the profitability of cashew production.

Global export connections: These provinces have long-standing trade relationships with major cashew importers like the United States, EU, China, and India, ensuring a steady demand for Vietnamese cashew nuts.

Low Production Costs

Provinces like Binh Phuoc and Dak Nong benefit from relatively low production costs compared to other regions, due to cheaper labor and land costs.

The availability of affordable labor from local rural populations helps reduce overall production expenses.

In conclusion, Vietnam's main cashew-producing provinces, such as Binh Phuoc, Dong Nai, and Binh Duong, are vital to the country's status as a global cashew supplier. These places have the advantage of good natural conditions, significant historical knowledge, and government backing, all of which lead to high yields and strong production efficiency. Furthermore, the growth of processing infrastructure and global export networks has enabled these provinces to maximize the value of their cashew harvests. As the business expands, these provinces will remain at the forefront of Vietnam's agricultural prosperity, bolstering the country's position in the global cashew markets.

Other News

View AllThe 2024/2025 blueberry season was a record, but the next one could be even better

Feb 25, 2025Dominus: Peru's Leading Frozen Grape Exporter

Feb 25, 2025Peru's Ginger Campaign Faces Ongoing Challenges

Feb 25, 2025Report: Global Agricultural Industry Value to Reach US$227 Billion by 2029

Feb 25, 2025Global Quinoa Market: Peru and Bolivia Face New Competition

Feb 25, 2025